In today’s digital age, the Indonesian government has made great strides in modernizing its services, and one such initiative is the online registration system for NPWP (Nomor Pokok Wajib Pajak), or Taxpayer Identification Number. Daftar NPWP Online, as it is known, has revolutionized the way Indonesians interact with the tax authorities, making it easier and more convenient than ever to fulfill their tax obligations. In this comprehensive guide, we will explore the intricacies of Daftar NPWP Online, its benefits, and the step-by-step process for obtaining your NPWP online.

What is NPWP?

Before delving into Daftar NPWP Online, it’s crucial to understand what NPWP is and why it’s essential for every Indonesian taxpayer.

What is NPWP?

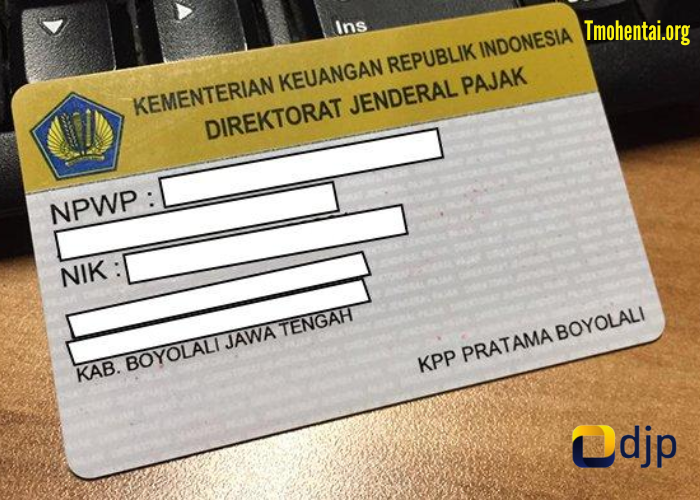

NPWP, which stands for Nomor Pokok Wajib Pajak, is a unique identification number issued by the Indonesian tax authorities to individuals, businesses, and other entities for tax purposes. It is a fundamental requirement for anyone who earns income or conducts business activities in Indonesia.

Why Do You Need NPWP?

NPWP serves several vital functions, including.

Tax Compliance

NPWP is essential for complying with Indonesian tax laws. Without it, individuals and businesses may face legal consequences and penalties.

Tax Reporting

It is used for reporting income, filing tax returns, and fulfilling other tax-related obligations.

A Game Changer

Daftar NPWP Online is a significant leap forward in simplifying the process of obtaining and managing your NPWP. It offers several advantages over traditional methods.

Convenience

Gone are the days of queuing at tax offices or dealing with heaps of paperwork. With Daftar NPWP Online, you can complete the entire registration process from the comfort of your home or office.

Time Saving

The online registration process is much faster than the traditional method. You can expect to receive your NPWP much sooner, allowing you to meet your tax obligations promptly.

Reduced Errors

Online forms are designed to minimize errors and inconsistencies, reducing the chances of delays or complications in the registration process.

Accessibility

Daftar NPWP Online is accessible 24/7, meaning you can initiate or update your NPWP registration at any time that suits you.

Frequently Asked Questions

To further assist you in understanding Daftar NPWP Online, let’s address some common questions.

Is Daftar NPWP Online available to everyone?

Yes, Daftar NPWP Online is available to both Indonesian citizens and foreign residents who meet the tax obligations in Indonesia.

Is it mandatory to have an NPWP?

Yes, it is mandatory for individuals and entities that earn income or conduct business activities in Indonesia to have an NPWP.

Are there any fees associated with Daftar NPWP Online?

As of my knowledge cutoff date in September 2021, the registration for NPWP is typically free. However, be sure to check the latest regulations for any updates on fees.

Tips for a Smooth Daftar NPWP Online Experience

To enhance your experience with Daftar NPWP Online, here are some additional tips.

Ensure Document Validity

Before you begin the registration process, double-check that all your supporting documents are valid and up-to-date. Invalid or expired documents can lead to delays in the approval process.

Verify Information Accuracy

Accuracy is crucial when entering your personal or business information. Any discrepancies can trigger additional verification steps or even rejection of your application.

Keep Records

Maintain records of your NPWP registration documents, including confirmation emails and application IDs. This will be useful for reference and in case you need to make updates or amendments in the future.

Stay Informed

Tax regulations can change, so it’s essential to stay informed about any updates or modifications to the Daftar NPWP Online process. Regularly check the official tax authority website for news and updates.

The Future of Daftar NPWP Online

As technology continues to advance, we can expect further improvements and enhancements to the Daftar NPWP Online system. Here are some potential developments on the horizon.

Mobile Applications

The development of mobile apps for NPWP registration could make the process even more accessible, allowing taxpayers to complete their applications on smartphones and tablets.

Enhanced Security Measures

To safeguard taxpayer information, we can anticipate the implementation of more robust security measures, such as biometric authentication and advanced encryption.

Integration with Other Services

In the future, Daftar NPWP Online may become more integrated with other government services and financial institutions, streamlining various administrative processes for taxpayers.

Conclusion

Daftar NPWP Online is a game changing initiative that simplifies tax registration and compliance in Indonesia. It offers convenience, efficiency, and accessibility to taxpayers, making it easier than ever to fulfill your tax obligations. By following the step-by-step guide provided in this article and staying informed about the latest regulations, you can streamline the process of obtaining your NPWP and ensure compliance with Indonesian tax laws. Embrace the digital age and take advantage of Daftar NPWP Online to simplify your tax affairs.